Are We Listening ???

- Wing Commander Pravinkumar Padalkar

- Feb 7, 2025

- 4 min read

Mark Twain remarked, “History doesn’t repeat itself, but it often rhymes.”

Markets are not indifferent; they follow patterns. Every few years, they exhibit similar trends. A bear phase is succeeded by a bull phase, with periods of consolidation in between.

However, like human behavior, we fail to learn from history. We simply respond to profits and losses, driven by emotions of joy, regret, and remorse.

The prolonged bull phase leads retail investors to become overconfident and overly enthusiastic. During this phase, everything appears more promising and appealing, amplified by the constant excitement and noise from the media.

Retail investors feel as though the good times will never end. This optimistic view clouds their ability to remember past experiences. Even those familiar with market cycles tend to forget the pain of losses.

For new investors, the challenge is particularly overwhelming. They have not witnessed any bear cycle and remain completely unaware of its consequences.

In life, when everything seems to be going perfectly for an extended period, it often signals that something unpleasant might occur. This is the time to stay vigilant and avoid complacency.

This is that moment in the market.

Following the pandemic, the last four years have been extraordinary for the markets. Profits were made by everyone. However, no celebration lasts indefinitely. It will conclude at some point, sooner or later.

Therefore, it is crucial to reevaluate our investment strategies. To do this, comprehending the real nature of the market is essential.

To grasp this market behavior, I have examined the annual returns of the Nifty 50 index over the past 25 years.

Here are a few interesting facts to ponder:-

Over twenty-five years, Nifty delivered negative returns in just four years: 2001, 2008, 2011, and 2015.

The lowest annual return is -51.79%, which occurred in 2008.

This implies that one should be prepared for a 50% correction in any given year.

In 2009, right after the severe downturn of 2008, we experienced the peak returns of 75.76%.

The market can surprise on the upside as well as on the downside.

Before 2008, we experienced a strong bull market for five consecutive years.

Since 2015, we have not experienced negative returns for the past nine years.

Therefore, there is a reason for concern and a need to avoid risks.

For ten out of the twenty-five years, Nifty provided returns of less than 10%.

In nine out of twenty-five years, Nifty delivered returns exceeding 20%.

This data from the last twenty-five years provides significant insight into stock market behavior. However, keep in mind that these are annual returns, meaning they are point-to-point returns.

Exploring data on SIP returns would be intriguing, as it would offer deeper insights into market dynamics.

Had someone initiated an SIP of Rs. 10,000 monthly in January 2007, during the peak of the bull market, the outcomes would have varied.

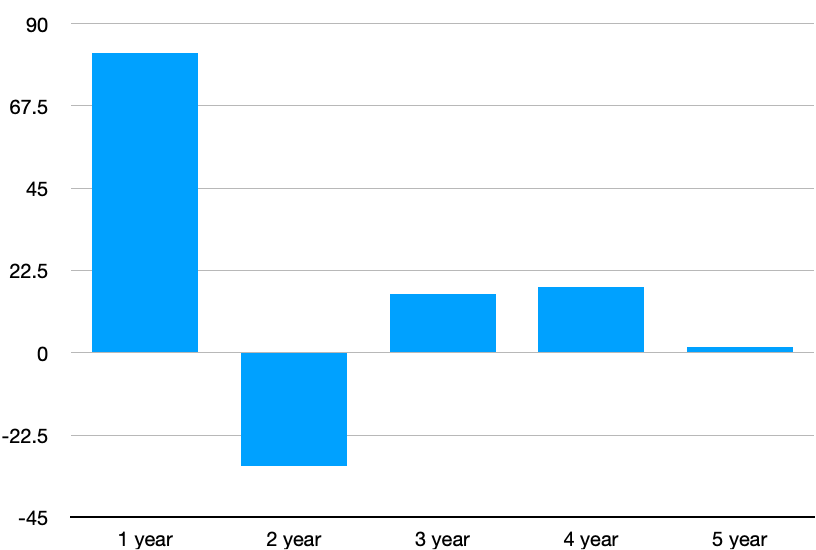

SIP period Duration CAGR returns

1 Jan 2007 to 31 Dec 2007 (1 year) 82.47 %

This ranks as one of the most impressive returns envisioned by any investor. This implies that an investment of Rs. 1.20 Lakh grew to Rs. 1.68 Lakhs within just one year.

Consider the mindset of this investor at this point. He will feel thrilled, overly confident, and enthusiastic. At this stage, he would disregard the fundamental risks tied to the stock market. He is prepared to take on more risks, anticipating high returns.

Thus, he carries on with his SIP for the upcoming year

1 Jan 2007 to 31 Dec 2008 (2 years) -31.21 %

His investment of Rs. 2.40 Lakh decreased to Rs. 1.66 Lakh over two years. This resulted in a loss of 73,000 rupees.

This is the introductory lesson for novice investors.

SIP investments may also yield negative returns over a short period.

What do you think his current feelings are? Joy, enthusiasm, and overconfidence have disappeared, giving way to pain, agony, and helplessness. Many investors will sell off their portfolios and leave, blaming their advisor for a lifetime.

Suppose this individual extended their SIP into the third year:-

1 Jan 2007 to 31 Dec 2009 (3 years) 16.69 %

Invested amount = Rs. 3.60 Lakh, Market value = Rs. 4.60 Lakh; Profit = Rs. 1 Lakh

By patiently waiting for another year and continuing the SIP despite observing negative returns, his Rs 73,000 loss transformed into a Rs 1 Lakh profit.

Suppose he waits an additional year:-

1 Jan 2007 to 31 Dec 2010 (4 years) 18.12 %

Invested amount = Rs. 4.80 Lakh, Market value = Rs. 6.860 Lakh; Profit = Rs. 2 Lakh

Thus, after a four-year wait, his profit rose to Rs. 2 Lakh.

Suppose he extends the SIP for an additional year.

1 Jan 2007 to 31 Dec 2011 (5 years ) 1.67 %

Invested amount = Rs. 6.0 Lakh, Market value = Rs. 6.26 Lakh; Profit = Rs. 26,000

This implies that after the fifth year, the profit decreased from Rs. 2 Lakh to Rs. 26,000.

This analysis shows that SIP returns can vary significantly.

Here are the key lessons we can derive from history:

The stock market remains unpredictable.

Returns are extremely volatile, and past performance does not guarantee future results.

Even SIP investments may yield negative returns at times.

Avoid being swayed by the market's fluctuations.

Do not get overly excited by gains or distressed by losses. Maintain a balanced demeanor.

Asset allocation is the most crucial aspect of investing.

Avoid investing all your assets in the stock market. Allocate some to fixed instruments like banks or post offices.

Do not borrow money or take loans for investing. This can be disastrous.

Your living expenses should not rely on market returns.

Diversifying your portfolio is essential. Avoid placing a large portion in small and mid-cap funds or high-risk funds merely for higher returns, as this can be detrimental.

Do not pursue returns. Focus on risk management instead of returns.

Invest for periods exceeding five years. The longer, the better.

13. Set a modest return expectation of 12%.

Here I have reviewed market data from the last twenty-five years. Even if we consider data from the past century, it will undoubtedly rhyme.

The more significant question is, “Are We Listening?”

.png)

Comments